Look at last year’s Utah Individual Income Tax Return, line 22 to determine how much state tax liability you had last year.

Make an estimate regarding what your state tax liability will be this year. You may donate the full amount of your tax liability.

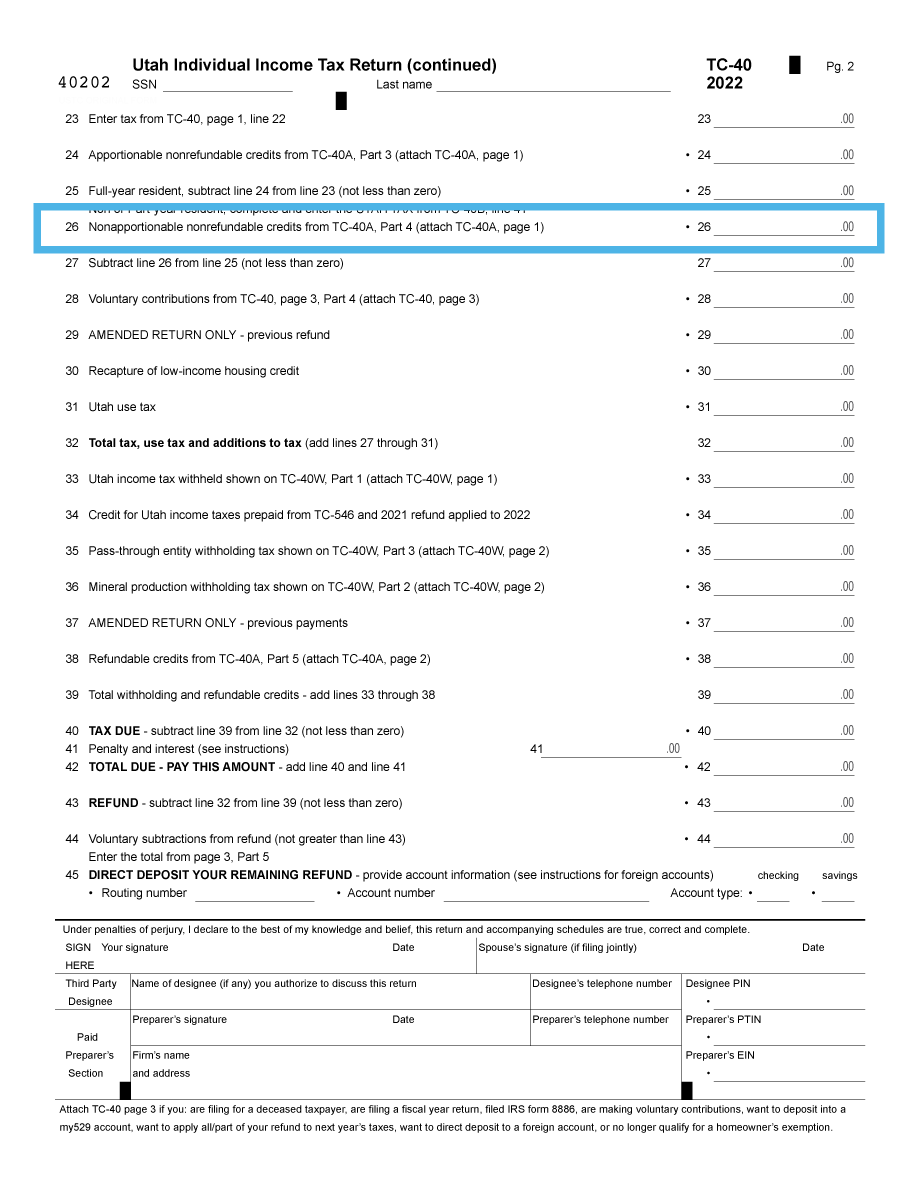

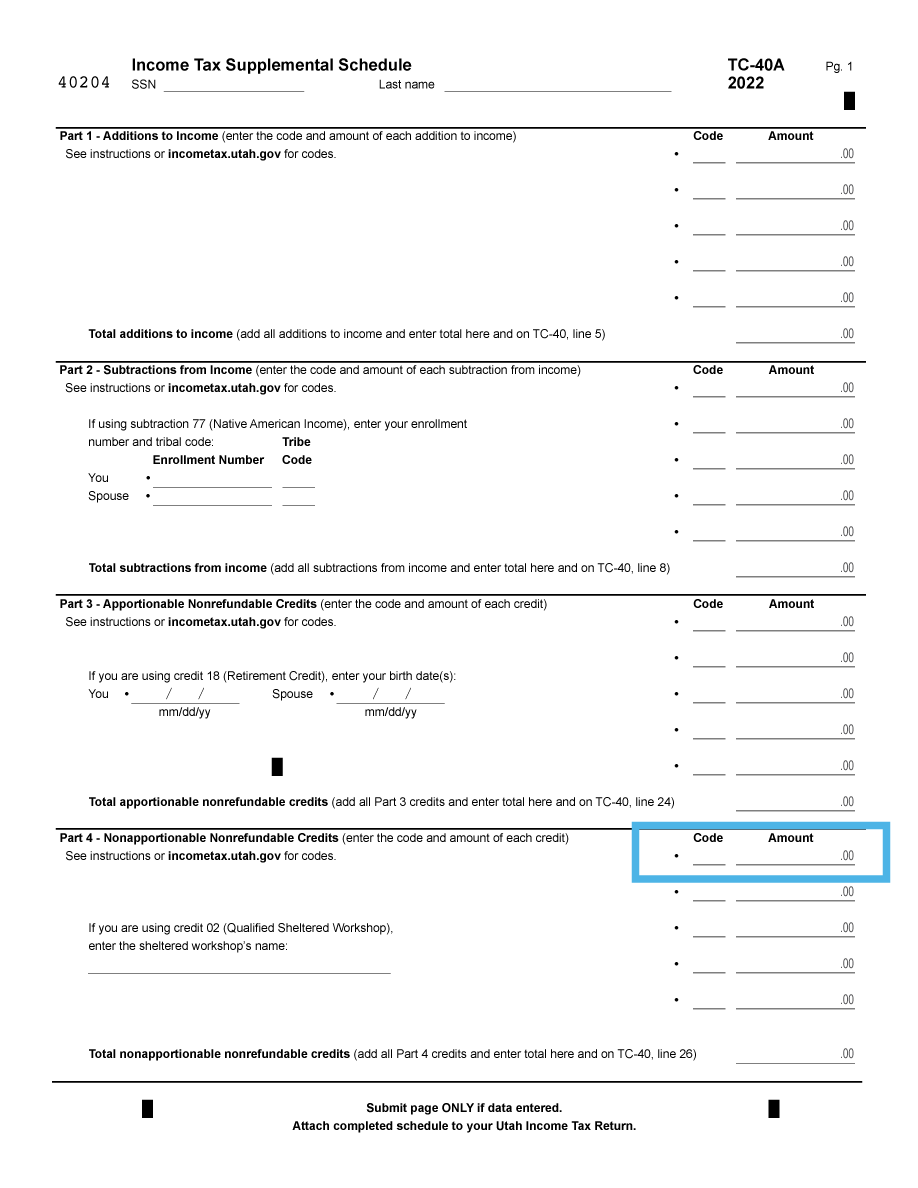

Enter the amount of your tax credit donation on line 26. You will need to attach the Income Tax Supplemental Schedule with Part 4 completed. Your donation may be the full amount of your tax liability. Children First Education Fund will provide you with a Tax Credit Certificate verifying your donation. You will not attach this certificate to your tax forms, but keep it for your records.

On the Income Tax Supplemental Schedule, enter the code related to the Special Needs Opportunity Scholarship Tax Credit: AG in the Part 4 Section.

Enter the amount of the donation that corresponds to Line 26 on page 2 of the Utah State Income Tax Form.

Hours: Monday – Friday 9am – 5pm

Phone: (801) 477-0057 for application inquiries

Phone: (801) 477-0484 for donation inquiries

Email: info@childrenfirsteducationfund.org

Address: 5414 W. Daybreak Pkwy., C-4 #433, South Jordan, UT 84009

Copyright © 2023 Children First Education Fund - All Rights Reserved