Filing Corporate State Income Tax Credits

For Corporations Claiming the Special Needs Opportunity Scholarship Tax Credit: Nonapprotionable Nonrefundable Credit Code AG

Step 1

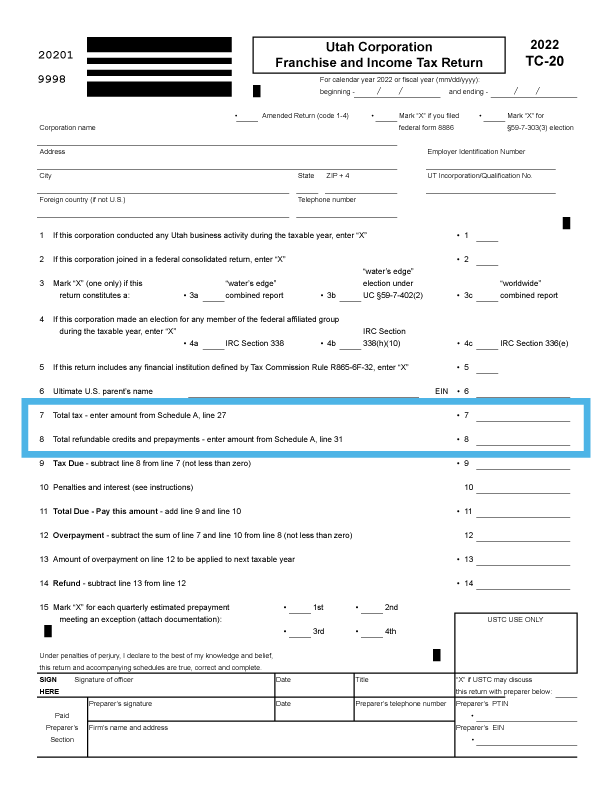

Look at last year’s Utah Corporation Franchise and Income Tax Return, line 7 to determine how much state tax liability you had last year.

Step 2

Make an estimate regarding what your state corporate tax liability will be this year. You

may donate the full amount of your tax liability. Enter this amount on line 8. You will need to attach Schedule A—Utah Net Taxable Income and Tax Calculation form with line 24 completed with donation information

Step 3

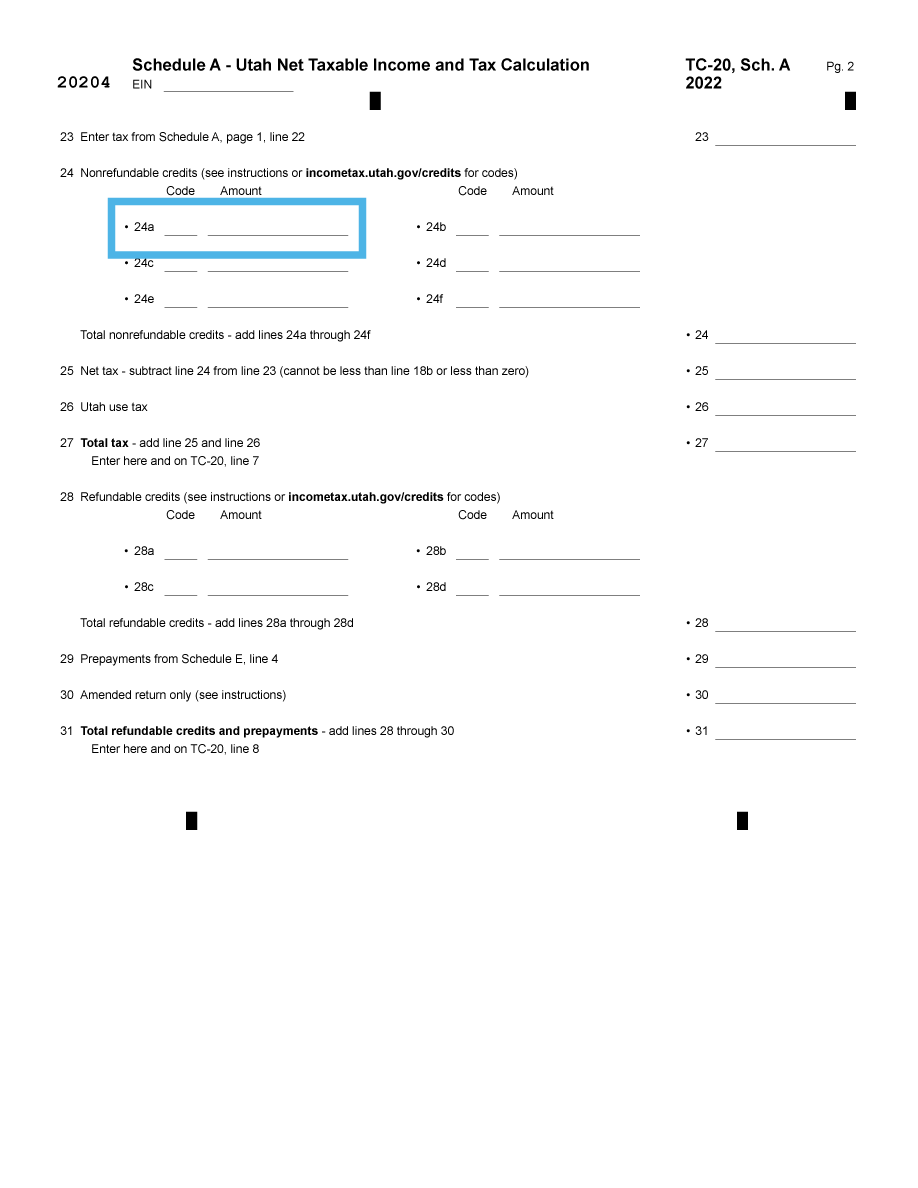

Enter the Code “AG” that represents the Utah Special Needs Opportunity Scholarship Tax Credit on Line 24a.

Step 4

Enter the amount of your tax credit donation on line 24a.

Your donation may be the full amount of your corporate tax liability. Children First Education Fund will provide you with a Tax Credit Certificate verifying your donation. You will not attach this certificate to your tax forms, but keep it for your records.